Profession tax is a tax levied by the State Government on salaried individuals working in Government or non-government entities or in the practice of any profession, including Chartered Accountants, Doctors, and Lawyers. Engineers, consultants, artists, etc., or carry out some form of business. The professional Tax comes under the preview of THE KERALA PANCHAYAT RAJ (PROFESSIONAL TAX) RULES 1996. This form of Tax is in practice for a long time, and States have conferred the power of leveling the Tax under Clause (2) of Article 276. The Profession tax rates are based on the Income Slabs set by the respective State Governments. However, the maximum Profession Tax that any State may levy has been capped at Rs 2500/-. The total amount of professional Tax paid during the year is allowed as a Deduction under the Income Tax Act.

For Employees, Profession Tax is deducted by the employers from the salary of the salaried employees, and the same is deposited with the State Government. Every establishment who have been appointed, working or holding office for salary or wages in any office or company or firm or enterprise or establishment or institution or receiving income from deposits and those having half-yearly income not less than Rs. 12,000/- must register under Professional Tax in Kerala. For other individuals, they have to pay it directly to the Government or through their respective Local Bodies appointed to do so. The Tax must be collected and deposited per the timeline provided by the respective State Government. If one fails to do so, a penalty and late fee will apply. The Tax is paid to the Government on a Semi-Annually basis.

Applicability of Professional Tax is based on ” Transacts Business.”

- The doing of acts or business of whatever nature, whether isolated or not, such as soliciting, obtaining, or transmitting orders or buying, making, manufacturing, exporting, importing, receiving, sharing, or otherwise dealing with goods

- Where to transact business, within the Panchayat area, a company or person has an office or an agent, the company or person shall be deemed to transact business within the Panchayat area whether or not such office or agent has the power to make binding contracts on behalf of the company or person, and person in charge of such office or the agent or firm, as the case may be, shall be liable for the Tax payable by the company or person;

- A company or person otherwise liable to pay professional Tax under Sections 204 and 205 shall not cease to be liable to such Tax by reason only if its or his head office or the place from which its or his business is controlled is situated outside the Panchayat area or by reason only of the fact that its or his transactions are closed outside the Panchayat area;

Explanation: A company shall be deemed to have transacted business, and a person shall be deemed to have exercised a profession, art, or calling or held an appointment within a Village Panchayat area if such company or person or persons has an office or place of employment within such Village Panchayat area.

Professional Tax Registration in Kerala

There is no special registration required for Professional tax compliance in Kerala. But some LSGD officials insist on bringing D & O Trade license for professional tax compliances. In Kerala, D & O Trade License is issued by the Health Department of the local self-government (LSGD).

To know more about the D & O Trade license, you can read our blog describing the D & O License. Then you get a complete idea about its applicability, registration procedure, scope, etc. You can find the link below.

Details required for Professional Tax Compliance

- Name of Employee

- Designation of Employee

- Half – Yearly Earnings of the Employee ( Basic + DA, Allowances, etc.)

- Request Letter from Authorized Person ( First Time only)

- Last paid Professional tax challan copy (Second time onwards)

Download Format of Professional tax return filing form in Kerala.

Contact : +91 9496353692

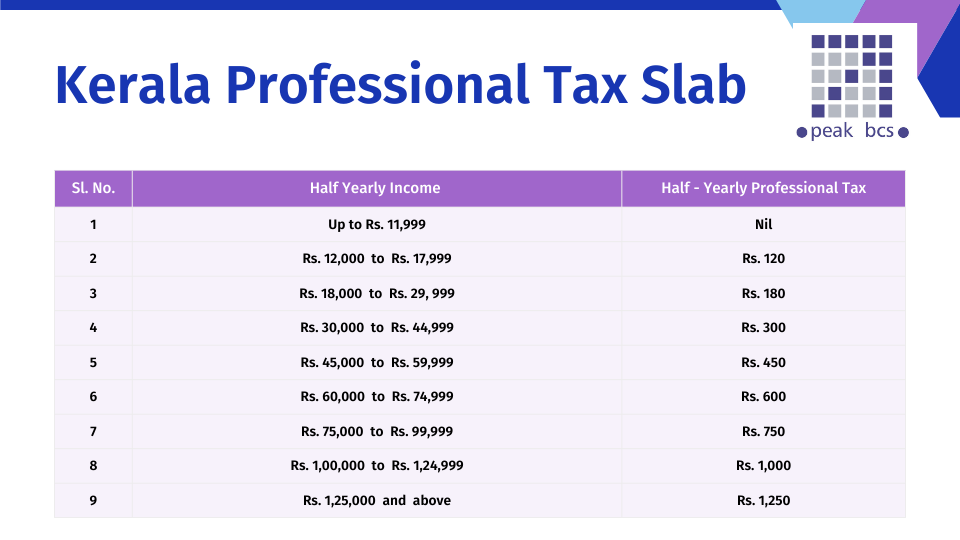

Professional Tax Rates, Collection Procedure, and Payment

To charge and collect professional Tax, employees can be grouped into categories according to the total income accrued on a half-yearly basis. In all other cases, the liable person who engaged in self-employment, companies, and those transacting business must pay the maximum professional Tax at RS. 1,250/- on half – yearly basis. The maximum professional tax deduction from a person is Rs. 2,500/- per annum. In Kerala, a D & O Trade license issued by the health department of local LSGD is mandatory for paying the professional Tax. Every person liable to deduct the professional Tax must pay the Tax along with the half-yearly return. The professional Tax deducted and delivered to the LSGD is available as a deduction under Income Tax Act 1961.

Download the Professional Tax Slab Rates applicable in Kerala

The due date for Return filing and payment

Every person liable to deduct the professional Tax as per the act must deposit the collected amount on the concerned account along with the return containing the income and professional tax deduction details.

The payment and return filing are half yearly basis. Due date of first half (April to September ) is August and Second half (October to March ) is February. All Statements made, returns furnished or accounts or documents produced, in connection with the assessment of profession tax by any company or person shall be treated as confidential and copies thereof shall not be granted to the public. We can avail professional tax paid amount as exemption at the time of Income Tax Return Filing.

Assessment by Local Panchayat, Municipality, and Corporation

Assessment of Profession tax for Traders, Institutions, and Self-Earning Professionals

The department creates a comprehensive list of traders and self-learning professionals in the Corporation limits through Bill Collectors and Revenue Inspectors. This list will also have an assessment of the Professional Tax. This assessment is done by the BC’s judgment based on his estimation of the establishment’s turnover.

Assessment of Profession tax – Employees: The Corporation will give notice every half year, requesting every head of office and employer to assess the professional Tax of all employees liable to pay the professional Tax in their institution and to remit the professional Tax in respect of every self-drawing officer.

Exemptions from Professional Tax deduction

- Parents of children with permanent disability or mental disability.

- Members of the forces as defined in the Army Act of 1950, the Air Force Act of 1950, and the Navy Act, of 1957, including members of auxiliary forces or reservists, serving in the state.

- Badli workers in the textile industry.

- An individual suffering from a permanent physical disability (including blindness).

- Women exclusively engaged as agents under the Mahila Pradhan Kshetriya Bachat Yojana or Director of Small Savings.

- Parents or guardians of individuals who have a mental disability.

- Individuals above 65 years of age.

Can we do Professional Tax Compliance Online?

Now we have multiple methods for professional tax compliance through online in Kerala.

- Professional Tax Online Payment System

2. K-SWIFT Portal (Kerala – Single Window Interface for Fast & Transparent Clearance)

To learn more about the Procedures for Online Compliance of Professional Tax in Kerala, Read our blog ” Online Professional Tax Compliance in Kerala.“

whether re-employed ex-servicemen are liable to pay profession tax

I think Ex-Servicemen are exempted from Professional Tax deduction.

iam running a saloon in a panchayat rural area with a annual income of 100000 i have missed 21-22 professional tax due to no earning during this year reason health and covid problem, can i pay professional tax 22-23 , will there be fine

Yeah. There will be a fine of 2 % per month. Better please check with the concerned Panchayat.