Goods & Service Tax (GST) is an Indirect Tax reform newly introduced in the Indian Indirect Tax System on July 01, 2017, to unify all the indirect taxes that prevails in the country. Before the introduction of Goods and Service Tax ( GST), there were diversified modes of taxes that prevailed in the Indian Indirect Tax System, which included State VAT, Central VAT, Excise Duty, Cess, and other local municipal taxes. The introduction of Goods and Services Tax in the Indian economy gives seamless opportunities to businesses here. The vital aspect seen after the GST implementations is simplifying procedural tasks, including GST registration, GST Return filing, and other litigation compliances. GST introduction enables the free flow of goods and services on Intra and Inter-State.

Goods and Service Tax (GST) was introduced to develop the competence of the Indian market with the world market. It is also a part of the One Nation, One, Tax One Market Reform. Goods and Service Tax ( GSTN) is a destination-based tax, which means the Place of supply will decide how a supply is taxed, i.e., SGST, CGST, UGST, or IGST. GST was introduced by consolidating existing taxes like Central Excise, Service Tax, State Vat, Entry Tax, Octroi, etc. GST Registration applies to all business forms like proprietorship, partnership firms, private companies, and LLPs. GST registration is unavoidable for even a small business in India in this competitive market. GST Registration helps small, micro, and medium businesses explore the opportunities to do business with corporate companies in India. So, the growth and development of every business have directly proportional to the Goods and service tax of the Country.

A GST (Goods and Services Tax) consultant is a professional who provides expert advice and assistance on GST-related matters to businesses and individuals. A GST consultant helps their clients comply with the various provisions and regulations of the GST law, and helps them in preparing and filing GST returns.GSTN Registration is essential for all prospective businesses who intend to develop their business seamlessly. Ourtaxpartner.com is responsible for supporting such companies to register under GST Portal.

The role of a GST consultant may include:

Overall, a GST consultant helps businesses navigate the complex GST system and ensure that they comply with all the legal requirements, while also minimizing their tax liability and optimizing their GST-related processes.

The Goods and Services Tax Network (GSTN) is a platform that provides the technological infrastructure for the registration, payment, return filing, and processing of GST in India. As per the GST laws, GSTN registration is applicable to all persons who are required to register for GST.

The applicability of GSTN registration depends on the turnover and nature of the business of the taxpayer. As per the GST laws, a person is required to register for GST if their aggregate turnover in a financial year exceeds the threshold limit specified for their category of business. The threshold limit for GST registration varies based on the type of business, and it is Rs. 20 lakhs for most businesses, and Rs. 10 lakhs for businesses located in certain special category states.

In addition to the threshold limit, certain other categories of persons are also required to register for GST, irrespective of their turnover. These include persons making inter-state supplies, casual taxable persons, non-resident taxable persons, and persons liable to pay tax under the reverse charge mechanism.

It is important to note that GSTN registration is mandatory for persons who are required to register for GST, and non-compliance with the registration requirement can result in penalties and legal repercussions. Therefore, it is recommended that taxpayers consult with a tax professional or a GST consultant to determine their GSTN registration requirements and ensure timely compliance.

The GSTN authorities introduced the Aadhaar authentication of Applicant / Key personnel as part of the GSTN allotment.

Under GST, registered taxpayers are required to file periodic returns summarizing their business transactions, sales, purchases, input tax credit (ITC), and tax liability for a given period. The GST returns need to be filed electronically on the GST portal, and the frequency of filing varies depending on the type of taxpayer and their turnover.

The GST returns can be filed by the registered taxpayer themselves, or they can hire a GST consultant or a tax professional to file their returns on their behalf. However, it is important to note that the responsibility of ensuring accurate and timely filing of GST returns lies with the registered taxpayer, and they may be liable for any errors or omissions in their returns, even if they have hired a third-party professional to file them.

Non-compliance with GST return filing requirements can result in penalties and interest charges, and may also impact the taxpayer’s eligibility for certain tax benefits and incentives.

In summary, GST return filing is an important compliance requirement under the GST regime, and registered taxpayers need to ensure that they file their returns accurately and timely to avoid any penalties or legal repercussions. It is recommended to consult with a GST consultant or a tax professional for guidance on GST return filing and compliance requirements.

Under the Goods and Services Tax (GST) regime in India, there are several types of GST returns and forms that taxpayers need to file, depending on their business activities, turnover, and registration status. Here are some of the most commonly used GST returns and forms:

GSTR-1: This return is used to report the details of outward supplies (sales) made by the taxpayer during a given period. It needs to be filed by all registered taxpayers, except for those who have opted for the composition scheme.

GSTR-2A: This is an auto-populated return that shows the details of inward supplies (purchases) that have been uploaded by the supplier in their GSTR-1 return. It helps taxpayers reconcile their purchase data with that of their suppliers.

GSTR-3B: This is a summary return that needs to be filed by all registered taxpayers on a monthly basis, summarizing their sales, purchases, input tax credit (ITC) claims, and tax liability for the period.

GSTR-4: This return is used by taxpayers who have opted for the composition scheme, which allows them to pay tax at a lower rate based on their turnover. It needs to be filed on a quarterly basis.

GSTR-5: This return is used by non-resident taxpayers who are registered under GST and are engaged in taxable supplies in India. It needs to be filed on a monthly basis.

GSTR-6: This return is used by Input Service Distributors (ISDs), which are entities that receive invoices for input services and distribute the ITC to other units within the same organization. It needs to be filed on a monthly basis.

GSTR-9: This is an annual return that needs to be filed by all regular taxpayers, providing a summary of their transactions for the entire financial year.

GSTR-10: This return needs to be filed by taxpayers who have surrendered their GST registration, providing details of their closing stock and tax liability for the period.

There are also other forms and returns that may be required to be filed in certain situations, such as GSTR-7 for taxpayers who deduct tax at source, GSTR-8 for e-commerce operators, and GSTR-11 for taxpayers who have been issued a Unique Identity Number (UIN) for diplomatic missions or other international organizations.

Persons listed under the following categories must register under the GST regime, and every person who comes under the below category is mandatory and registered under GST Portal. You can avail of 24 * 7 hours services from Ourtaxpartner.com for GST Registration, Monthly Return Filing, and all other statutory compliances associated with GST Act and Rules. GST Registration in Kochi and Ernakulam is now with Ourtaxpartner.com, the best GST consultants in Kochi, Kerala.

GST registration is the process of registering for the Goods and Services Tax (GST) with the GST authorities. Once registered, a GST identification number (GSTIN) is issued to the taxpayer.

Any business or person that supplies goods or services with a turnover exceeding Rs. 40 lakhs (Rs. 20 lakhs for some special category states) is required to register for GST.

The documents required for GST registration include PAN card, Aadhaar card, proof of business registration, bank account details, and other business-related documents.

GST registration can be obtained within 7-10 working days, provided that all the documents are in order and there are no discrepancies in the application.

Yes, one can do GST registration on their own by visiting the GST portal and following the registration process. However, it is recommended to seek the help of a GST consultant or a tax professional to ensure that the registration process is smooth and error-free.

No, there is no fee for GST registration.

The penalty for not registering under GST can be up to 10% of the tax amount due, subject to a minimum of Rs. 10,000.

Yes, any business or person engaged in the inter-state supply of goods or services is required to register for GST, regardless of their turnover.

The validity of GST registration is until the registration is canceled or surrendered.

Yes, GST registration can be canceled by submitting an application for cancellation on the GST portal. The application is processed within 30 days, and the registration is canceled from the effective date mentioned in the application.

In India, under the Goods and Services Tax (GST) regime, only registered taxpayers are authorized to file GST returns. Any person or entity who is registered under GST and has a valid GSTIN number can file GST returns.

GST returns can be filed by the registered taxpayer themselves, or they can hire a GST consultant or a tax professional to file their returns on their behalf like Ourtaxpartner.com. However, it is important to note that the responsibility of ensuring accurate and timely filing of GST returns lies with the registered taxpayer, and they may be liable for any errors or omissions in their returns, even if they have hired a third-party professional to file them.

Additionally, under certain circumstances, the GST authorities may also require non-registered taxpayers to file GST returns, such as non-resident taxpayers who supply taxable goods or services in India. In such cases, the non-registered taxpayer may need to obtain a GST registration before they can file their returns.

Every business registered under the GST Act must report their sales, purchase, input tax credit, and output tax payable to GST authorities on a monthly or quarterly basis as applicable through the common portal for GST; this process is called GST Return E-filing. And the GST return filing is mandatory for every GSTN holder, even small or big enterprises. GST Registration and Return filing in Kochi and Ernakulam are now simple with Ourtaxpartner.com.

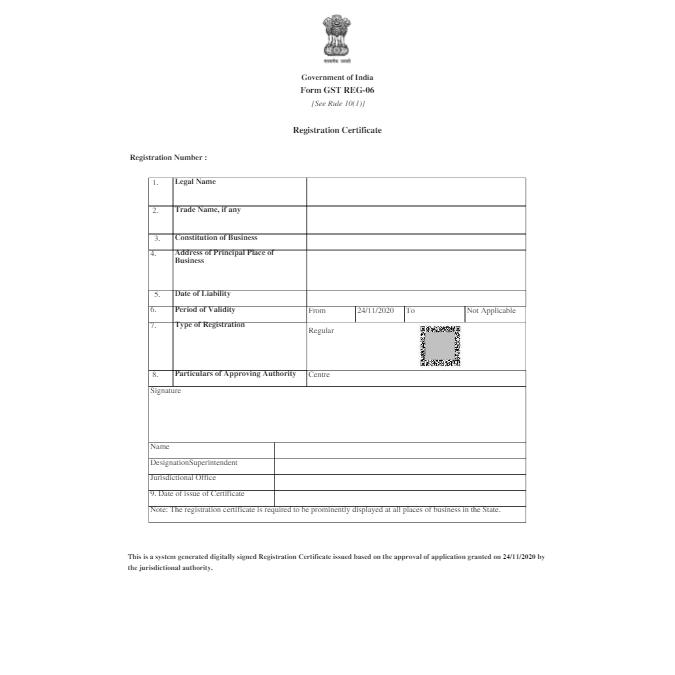

As per GST rules, a person with turnover exceeding the specified limit will register under the GST portal https://www.gst.gov.in/. Now the limit of turnover is 40 lakhs. Submitting an online application named Form GSR REG 01 is called GST registration. GST registration usually takes 3 to 7 working days, and get the GST Certificate online.

If a trader has Multiple Business Verticals in a state, separate GST registration for each shall be taken. Those not liable to take GST registration can also register under the GST portal. Traders who apply for GST registration must have a PAN card. Those with tax deductions in the source must have TAN (Tax Deduction and Collection Account Number) and PAN.

Every GSTN (Goods and Service Tax Number) holder must file monthly sales data, purchase data, input tax credit data, and other information as required by the Goods and Service Tax Rules. For submitting this data, the GST department issued various GSTR forms like GSTR – 01, GSTR -02, GSTR -03, GSTR – 3B, GSTR – 04, GSTR – 05, GSTR – 06, GSTR -07, GSTR – 08 and GSTR -09. The process of submission of these forms to the GST online portal is called GST Return Filing.

After approval of GSTN by the Commercial Tax Officer, You will receive a mail with a subject of ” Welcome GST Family” mentioning the allotted GSTN and temporary password.

Step 1 : Reset the GSTN Password

Step 2 : Login into GSTN Dashboard

Step 3 : Click on ” View Profile “

Step 4 : Find ” My Registration Certificate ”