A company incorporated by shares may be ” Public Limited ” or ” Private Limited.” In both cases, the company is incorporated under the preview of” The Companies Act, 2013 (previously The Companies Act 1956). A Company is a separate legal entity with perpetual succession for lawful purposes. A private company is formed with Authorized Capital, and this capital is divided into shares of a fixed face value. The minimum authorized capital to incorporate a private limited company in India is Rs. 1 Lakhs. Two is the minimum shareholders and directors required for a private limited company. The shareholders may act as directors. The first subscribers of the company are known as promoters of the Private Limited Company. In India, the incorporation of a company is under the control of the Ministry of Corporate Affairs, shortly known as MCA. The Registrar of Companies (ROC) operated under MCA will be the Company affairs’ verifying and certifying authority.

Limited by Shares and Limited Liability Partnership Firms (LLP) are incorporated under the Ministry of Corporate Affairs.

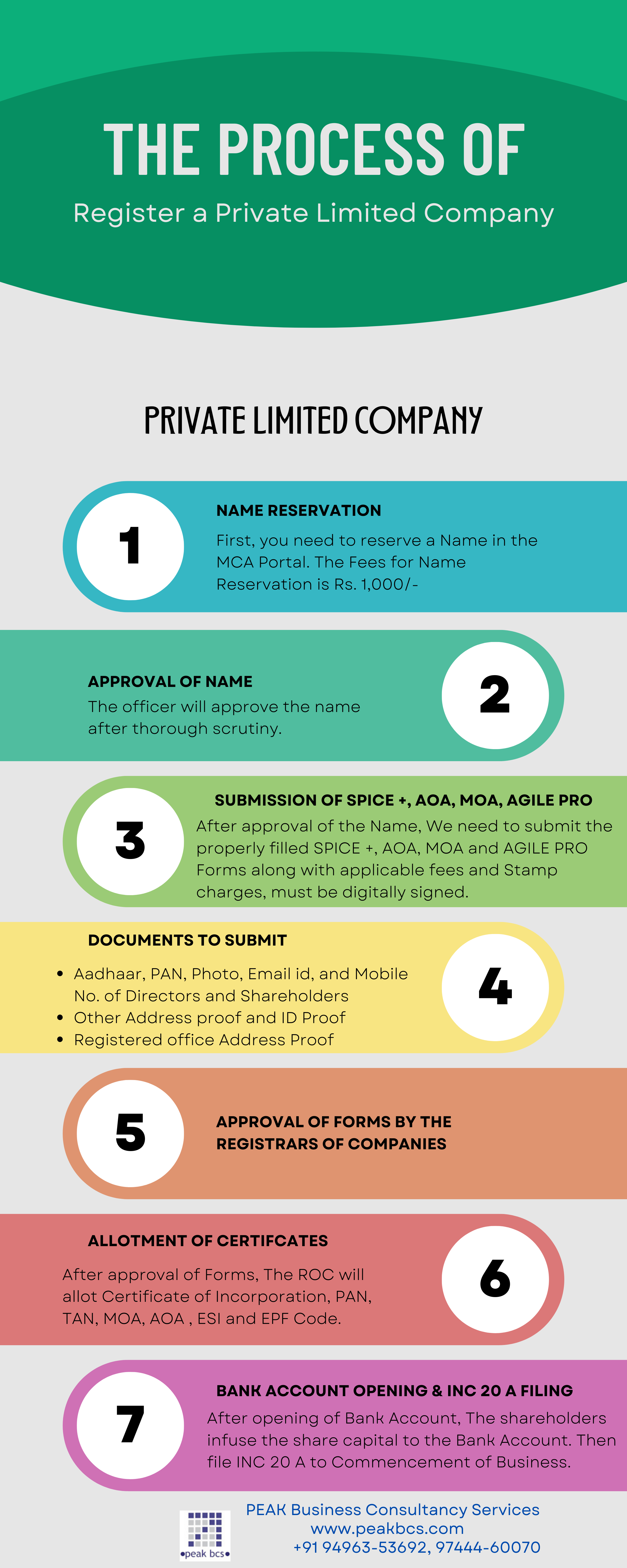

Registration procedure – Private Limited Company (PLC)

Name Reservation :

Every entrepreneur who wishes to register a private company requires a name for the business. The name is not identical to the existing registered companies, so conduct a thorough search on the company and trademark registries. The MCA fee for reserving a name for a company is Rs. 1,000/- and a validity of 15 days after allotment of the name. The name is reserved on Spice + (Part A) per the new amendments.

http://www.mca.gov.in/mcafoportal/showCheckCompanyName.do

https://ipindiaonline.gov.in/tmrpublicsearch/frmmain.aspx

Digital Signature Certificate (DSC):

Obtain digital signature for the first subscribers and directors of the company. A private limited company must have a minimum of 2 shareholders and two directors.

Form filling for Registration:

The various forms for PLC Registration are Spice + (Part 2), E-MoA, E-AoA, Form INC 9, and AGILE PRO. As per the new amendment in company online registration in the MCA portal, the applicant fills out the forms online after login on MCA Portal and downloads the document in PDF after pre-scrutiny. Then affix the DSC of Directors and verifying Authority (CA / CS / CMA / Advocate).

After Login on MCA Portal >.. MCA Services >.. SPICE+

After affixing the DSC in all forms, upload in MCA Portal and pay the prescribed fees.

Now we can apply for DIN, PAN, and TAN through Spice + form. Also made mandatory for registering ESI, EPF & Opening a Bank Account for newly incorporated companies w.e.f. February 23, 2020. In the State of Maharashtra, professional tax registration is also mandatory.

Note: Every newly incorporated company must file the return under ESI & EPF within six months of incorporation or rules applicable, whichever is earlier.

Approval by Registrar of Companies:

The certifying authority, i.e., Registrar of Companies (ROC), verifies the application and allows the Corporate Identity Number (CIN). We can also get an approval mail along with the Certificate of Incorporation as its attachment.

Commencement of Business:

Every company incorporated after November 02, 2018, must file FORM INC 20A within six months to obtain a Certificate of Commencement; otherwise, MCA may disqualify the directors and charge huge penalties.

Documents required for Company Incorporation

- PAN & Aadhaar card of Directors & Promotors

- Email, Phone No. & Education Qualification of Directors & Promotors

- DIN (if a director have already a valid DIN)

- Digital Signature of Directors & Promotors

- Address proof of Directors & Promotors (Bank / Electricity Bill/ Telephone bill/ Mobile bill)

- Proof of Identity of Directors & Promotors (Voters Identity Card/ Passport/ Driving License)

- Passport Size Photo of Directors

- Proof of Registered office (Copy of Utility bill not older than two months)

- Latest Building Tax Receipt

- Rent Agreement / NOC from Owner with Certificate of Ownership

- Statement of Directors in FORM DIR 2 (Format available in downloads)

- Specimen Signature of Authorized person in EPF (Format available in downloads)