Contact : +91 9496 353 692

Partnership firms are one of India’s most popular forms of business constitutions. Partnership firms are most popular because of their simplicity in formulating and easiness of managing legal compliances like Income Tax and Financial Audits. So it is too familiar in the Indian business world. Partnership firms registered in India must comply with the rules and guidelines of “The Indian Partnership Act, 1932 “. The primary document of every partnership firm is a deed mutually signed by its partners. This deed describes the relationship, authority, remuneration, rights, and duties of the firm’s partners. So the deed controls the overall administration of a partnership firm. So every business that wishes to register as a Partnership firm in India must constitute a Deed on a Stamp Paper (the value of the Stamp Paper depends upon the concerned State Stamp Acts) among the partners. In Kerala, the stamp paper value is Rs. 5,000/- ( Five Thousand only).

The business constitutions other than Partnership firms that are popularly available in India are Proprietorship firms, Private Limited Companies, Public Limited Companies, One Person Companies (OPC), HUF, and Limited Liability Partnerships, etc. PEAK Business Consultancy Services, Kochi, Ernakulam, Kerala, helps entrepreneurs register their businesses in all the above formats. We assure you of world-class service here. Entrepreneurs can reach us for business registration assistance.

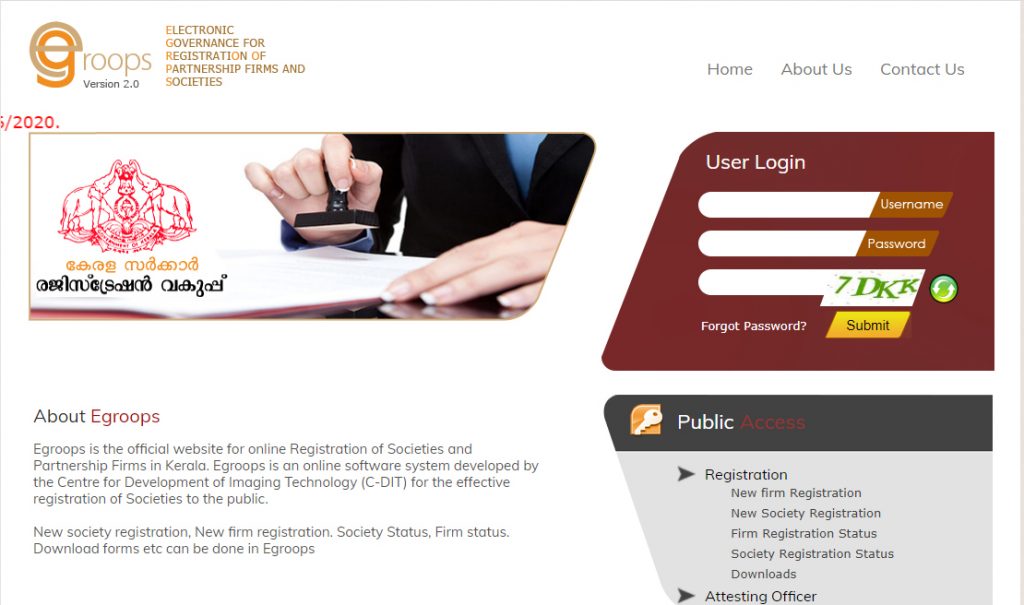

Now we can register a Partnership Firm online in Kerala under the portal maintained by the Registrar of Firms, Kerala, named “EGROOPS.” Partnership firm registration online procedures in Kerala are straightforward to follow, and a commoner can also do it without the support of a professional consultant like us. But a competent person’s digital attestation (using DSC) must be required in the Online application submitted by the partner before the Registrar of Firms. For those who feel difficulties, cannot follow the online registration procedures or need assistance with digital attestation (Competent Person) in the online application, PEAK Business Consultancy Services assist them in doing the online registration procedures of Partnership firms under EGROOPS.

The act describes the ‘Partnership Firm‘ and ‘Partner of a Partnership Firm‘ as

"Partnership" is the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all. Persons who have entered into partnership with one another are called individually, "partners" and collectively "a firm", and the name under which their business is carried on is called the "firm-name"

Characteristics of Partnership Firms in India

The minimum number of partners required to form a Partnership firm business is 2. The maximum number of partners in a partnership firm is 100. A Partnership firm has no separate legal entity from its partners. Every partner has unlimited liability in a partnership firm, and the partner’s assets are legally liable against the Partnership’s debts and liabilities. The registration of the Partnership deed is not mandatory by rules. The constitution of a Partnership Deed itself is enough to do business as a ” Partnership Firm.” In a Partnership business, a partner cannot transfer his interest without the consent of other Partners. A partnership firm has no perpetual succession, which means any change in membership, death, or retirement will affect the existence of the Partnership firm. So, any such change will cause the reconstitution of a Partnership Deed.

Why Partnership Firm?

Partnership firm provides an excellent opportunity for entrepreneurs to do business as a group to mobilize more money for massive capital-oriented business projects. Most individuals who wish to do business with groups opting Partnership Firms because of their limited legal compliance, ease of management, easiness of registering a partnership firm, etc. The legal compliance and professional administration cost are comparatively less compared to Private Limited Companies and LLPs. Concerned state departments govern partnership firms, so the State Government controls the registration procedures. Now Registration procedure of a partnership firm is simplified by the State Governments to promote trade and commerce in the Country. Registrar of Firms, Kerala, is the competent authority to control and regulate the Partnership Firms in Kerala. Partnership firm registration online in Kerala will come under the control of the Registrar of Firms, Kerala.

Benefits of the Partnership Firm

- Easy to Register: Partnership firms are easy to formulate with fewer legal procedures, and partnership firms can start the business immediately after entering the partnership deed. Online Partnership firm registration is now facilitated under the portal EGROOPS maintained by the Registrar of Firms, Kerala.

- Simple Name Selection Procedure: Partnership firms are simple forms of business to start as groups. The name selection of a partnership firm is straightforward, and we can use any name for a partnership firm otherwise than by a detailed search.

- No Statutory Audit / Annual Returns: Like a Private limited company / Public limited / LLP, a Partnership firm doesn’t have any statutory audit except the Income Tax Audit. No annual audit or annual return filing by the Registrar of Firms and tax audit applies to firms whose turnover exceeds the income tax threshold limit.

- Less legal compliance: Compared with ROC Registered businesses, Partnership businesses have less legal compliance.

- Sharing of Risk: A partnership firm enables risk sharing between the partners. That means the entire liability of the partnership firm will not come to a single Partner otherwise stated in the deed.

- Presumptive Tax Filing Scheme: Partnership firms can benefit from the Presumptive Tax Return Filing Scheme under Income Tax Act 1961. Income Tax Return Filing is mandatory for all Partnership Firms. Get support from us to file the Business tax return of your partnership business. The income tax percentage for a Partnership firm is flat 30% plus applicable Cess and Surcharge.

- A partnership firm may have registered or unregistered

Contact : +91 9496 353 692

EGROOPS – Partnership Firm Registration Procedure in Kerala

In Kerala, Partnership firms are registered under “The Registration Department of Kerala (Registrar of Firms, Kerala). The online application form for registration of a Partnership firm is FORM 1. Now, Form 1 is submitted online through the EGROOPS portal. For firms and society registration, the department introduced a new portal for its ease of business, and registration in Kerala is ” EGROOPS. ” Electronic Governance for Registration of Partnership Firms and Societies (EGROOPS) is the official website for the online Registration of Societies and Partnership Firms in Kerala.

EGROOPS is developed by the Center for Development of Imaging Technology (C-DIT) for the easy registration of Partnership firms and Societies to the public in Kerala. The Registration fee for partnership firms is Rs. 500 only, and the applicant can pay the challan through an Online/ Demand Draft/ Money Order. From October 7, 2019, only E- Payment is accepted by EGROOPS.

The Communication address of EGROOPS / Registrar of Firms Kerala is

Inspector General, Department of Registration, Vanchiyur P.O, Thiruvananthapuram, Kerala – 695035 Email: [email protected], Phone: 0471-2472118, 2472110

In the Egroops portal, we can do the following activities:

- New Partnership Firm Registration / Amendments in Partnership Firms

- New Society Registration / Amendments in Society

- Search Partnership Firm Registration Status

- Society Registration Status

Partnership Firm Registration Procedure in Kerala

- Partnership firm name search: EGROOPS Portal provides a name search facility to check the availability of preferred Names. Better to avoid the identical name to ensure non-rejection of the application.

- Partnership Deed Preparation (As per Kerala stamp duty and Registration fees Partnership Instrument of Partnership deed at Rs. 5,000)

- Online Partnership Firm Registration in Kerala under EGROOPS

How to Register a Partnership Firm in EGROOPS? Detailed step-by-step procedure of Partnership firm EGROOPS Registration Procedure.

Step 1: Create a login in Egroops with any partner’s Email id.

Step 2: After login, Click on ” Firm Registration” and fill in the details of New Firm and Partner details.

Firm Details to Enter :

- Name of Partnership Firm

- Duration of Partnership Firm

- Principal Place of Business

- Building No. & Address of Business

- Email id & Phone Number

- No. of Partners

Partner Details to Enter :

- Partner Type

- Name of Partner

- Age & Gender of Partner

- Name of guardian

- Relationship with guardian

- Date of Joining

- Address & Phone Number

- Upload Photo, Id Proof ( PAN & both sides of Aadhaar Card) & Specimen Signature of Partner

Step 3: Make the Payment of Rs. 500/- ( Modifications in partnership firm details will charge Rs. 200/- )

Mode of Payment: Online (From October 7, 2019, onwards, only E- Payment is accepted by Egroops)

(On receiving payment, you will receive a confirmation message and reference number for future reference, the same will send to the registered mobile number and email ID )

Step 4: Attestation of application with the registered Attesting officer.

Step 5: Review of Application by the Concerned Authority and Issue the “Acknowledgement of Registration of Firm.”

Note: In the EGROOPS Registration procedure, no need to upload the Partnership Deed.

Instructions for uploading Photo, Specimen Signature, and Id proof of Partners in EGROOPS Portal.

For uploading photos of partners – JPG / JEPG format, File size up to 40 KB, Dimension: 150 * 200

For specimen signature of Partners – JPG / JEPG format, File size up to 40 KB

For ID proofs of Partners – PDF Format, File size up to 2 MB, Merge the Aadhaar and PAN as one document

Legal Documents and Licenses applicable for a Partnership Firm

- Partnership Firm Deed mutually signed by Partners

- PAN Card ( In the Name of Partnership Firm)

- TAN ( For TDS deductions and return filing)

- Bank Account – Current

- GST Registration ( if turnovers exceed the limit)

- D & O Trade License

- Shop and Establishment License

- Labour Welfare Fund Registration

- Import Export Code ( Business engages in the activity of export/import)

- FSSAI Registration / License ( For doing food-related business)